The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Researchers found that ChatGPT-powered trading strategies crushed the market — until everyone found out. Here's what AI can actually do for your investing (and where it falls flat), plus a prompt you can use today to analyze any stock headline.

A trading strategy powered by ChatGPT returned 500%.

Not 50%. Not 5%. Five hundred percent.

Meanwhile, the S&P 500 lost 12% over the same period.

That's the headline from a University of Florida study that sent shockwaves through the finance world. Researchers fed ChatGPT over 50,000 stock headlines and asked a simple question: Is this good or bad news for the stock price?

The AI didn't just get it right. It got it right 90% of the time — and outperformed every traditional sentiment analysis tool Wall Street has been using for years.

So why isn't everyone rich?

The Catch Nobody Talks About

Here's what the breathless headlines leave out:

1. The edge disappears when everyone uses it. The same researchers found that strategy returns decline as more investors adopt AI tools. The advantage isn't the AI — it's being early.

2. It's still wrong 40% of the time. A 60% hit rate sounds impressive until you realize that means 4 out of 10 trades go against you. In volatile markets, that's enough to wipe out months of gains in a single bad week.

3. AI reads headlines. It doesn't understand markets. ChatGPT is exceptional at parsing language — detecting nuance, sarcasm, second-order implications. What it can't do: predict black swan events, understand when markets are being irrational, or know that the CEO's "stepping down to spend time with family" actually means the SEC is calling.

Where AI Actually Helps

Here's the honest version: AI won't pick stocks for you. But it can make you a faster, more informed investor.

Think of it like a research assistant who reads 1,000 articles while you sleep:

Sentiment analysis — Is the news positive or negative? AI catches nuance humans miss.

Pattern recognition — Spotting trends across hundreds of earnings calls in seconds.

Information synthesis — Summarizing a 50-page 10-K filing into the three things that matter.

The edge isn't letting AI trade for you. It's using AI to see what you'd otherwise miss — then making your own call.

How to Use It

You don't need a $50,000 Bloomberg terminal. Here's a practical way to use ChatGPT for stock research:

Find a headline or news story about a stock you're watching

Paste it into ChatGPT with the prompt below

Use the analysis as one input — not gospel

The Prompt (Copy This)

You are a financial analyst. I'm going to share a news headline or article about a company. Analyze it and tell me:

1. Is this likely POSITIVE, NEGATIVE, or NEUTRAL for the stock price in the short term (1-5 days)?

2. What's the second-order implication most investors might miss?

3. What additional information would you need to be more confident?

Be specific and concise. Here's the headline:

[PASTE HEADLINE OR ARTICLE HERE]

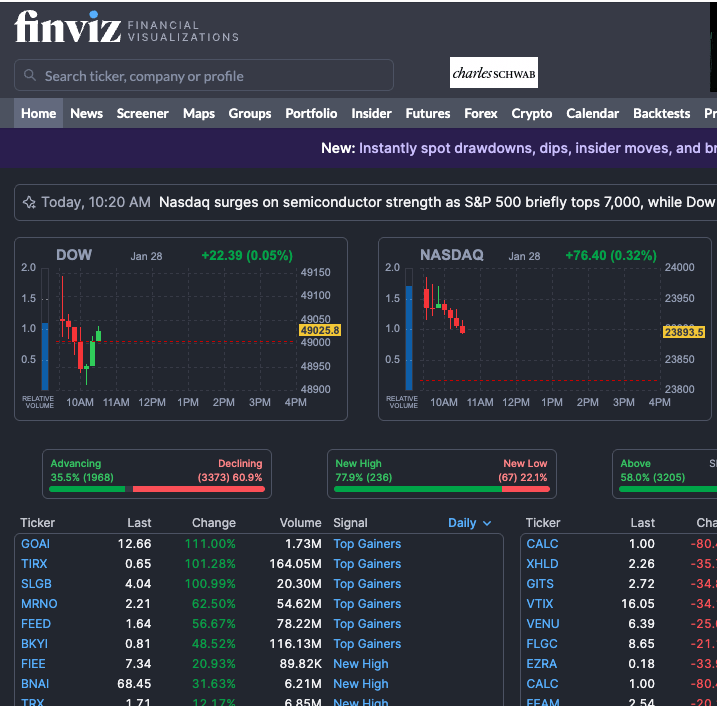

🛠️ Tool Worth Knowing: FinViz

If you want to scan for stocks before digging into headlines, FinViz is the free screener most traders don't know about. Filter by sector, market cap, technical signals — then run those tickers through your AI analysis.

How to Get FinViz:

🌐 Web: finviz.com (free tier available)

📱 Mobile: Browser-based (no app needed)

💻 Desktop: finviz.com/elite for real-time data ($24.96/mo)

Start with the free heat map to see what's moving today.

🗞️ Quick Bites

OVER 100 FAKE CITATIONS FOUND IN TOP AI PAPERS

GPTZero discovered that 51 papers accepted at NeurIPS — one of

AI's most prestigious conferences — contained hallucinated

sources. Including fake authors named "John Doe." Peer review

isn't what it used to be.

────────────────────────────────────────────────────────────────

OPENAI AND SPACEX EYEING 2026 IPOs

Both companies reportedly planning market debuts this year.

OpenAI is targeting a valuation up to $1 trillion. If both go

public, 2026 could be the year we finally see real financials

from AI's biggest players.

────────────────────────────────────────────────────────────────

FED WATCHING AI PRODUCTIVITY GAINS

The Federal Reserve's January meeting (wrapping up tomorrow)

may touch on AI's impact on productivity. Translation: the Fed

is starting to factor AI into inflation and job market

forecasts. This matters for rate decisions.

⚡ Your Action Step

Pick one stock you're watching. Find the most recent news headline about it. Run it through the prompt above.

Notice what ChatGPT catches that you might have missed — and what questions it raises that only you can answer.

That's the real edge: AI speed + human judgment.

📚 Sources

STATS & RESEARCH

────────────────────────────────────────────────────────────────

ChatGPT 500% returns / 90% accuracy on market reactions

→ University of Florida: "Can ChatGPT Forecast Stock Price

Movements? Return Predictability and Large Language Models"

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4412788

Transformer models outperform traditional neural networks

→ South Dakota State University / Finance Research Letters

https://phys.org/news/2025-11-ai-outperform-neural-networks-stock.html

Strategy returns decline as AI adoption increases

→ University of Florida (same study, Section 6)

NEWS BITES

────────────────────────────────────────────────────────────────

NeurIPS hallucinated citations

→ GPTZero / Business Insider

https://www.humai.blog/ai-news-trends-january-2026

OpenAI / SpaceX IPO reports

→ Gizmodo / Reuters

https://gizmodo.com/2026-is-poised-to-be-the-year-of-the-tech-ipo

Fed AI productivity discussion

→ Yahoo Finance / Principal Asset Management

https://finance.yahoo.com/video/ai-productivity-may-be-key-topic-for-fed-in-2026

|

Pro‑Grade Material Weights in SecondsBuilt for contractors, architects, and engineers.

Trusted by Pros Nationwide. |

About This Newsletter

AI Super Simplified is where busy professionals learn to use artificial intelligence without the noise, hype, or tech-speak. Each issue unpacks one powerful idea and turns it into something you can put to work right away.

From smarter marketing to faster workflows, we show real ways to save hours, boost results, and make AI a genuine edge — not another buzzword.

Get every new issue at AISuperSimplified.com — free, fast, and focused on what actually moves the needle.

|

If you enjoyed this issue and want more like it, subscribe to the newsletter.

Brought to you by Stoneyard.com • Subscribe • Forward • Archive