Investment newsletters sell answers; good research builds filters

AI is best used before you look at prices

The goal is not picks, but narrowing what’s worth thinking about

You can kill 80 percent of bad ideas in minutes with the right prompts

This workflow works even if you never place a trade

Winning “Brewery of the Year” Was Just Step One

Coveting the crown’s one thing. Turning it into an empire’s another. So Westbound & Down didn’t blink after winning Brewery of the Year at the 2025 Great American Beer Festival. They began their next phase. Already Colorado’s most-awarded brewery, distribution’s grown 2,800% since 2019, including a Whole Foods retail partnership. And after this latest title, they’ll quadruple distribution by 2028. Become an early-stage investor today.

This is a paid advertisement for Westbound & Down’s Regulation CF Offering. Please read the offering circular at https://invest.westboundanddown.com/

The Reframe

Most people think investment research starts with a stock.

It doesn’t.

It starts with patterns: incentives, demand that won’t go away, businesses people complain about but still pay for.

Stock lists feel useful because they remove thinking. But they quietly replace judgment with trust.

The real shift is using AI upstream. Before models. Before charts. Before opinions.

In practice, the win is not finding “the next big thing.”

It’s building a repeatable way to decide what deserves your attention at all.

This issue is not about buying anything.

It’s about using ChatGPT-5 as a research analyst that helps you think more clearly, faster, and with less bias.

The Insight

AI is bad at predicting prices.

AI is excellent at organizing ambiguity.

That makes it perfect for early-stage investment research.

Used correctly, ChatGPT-5 helps you:

Turn vague themes into concrete industries

Surface risks before you get attached

Compare businesses on structure, not hype

Ask better second-order questions

What actually matters is not speed or volume.

It’s reducing false positives.

If you can eliminate weak ideas early, you preserve attention for the few that deserve deeper work. That’s the leverage.

How to Use It

Below is a simple three-stage AI research workflow. Each stage has one job.

Mode 1: Opportunity Discovery (Wide Funnel)

You are not searching for companies.

You are searching for interesting environments.

Prompt:

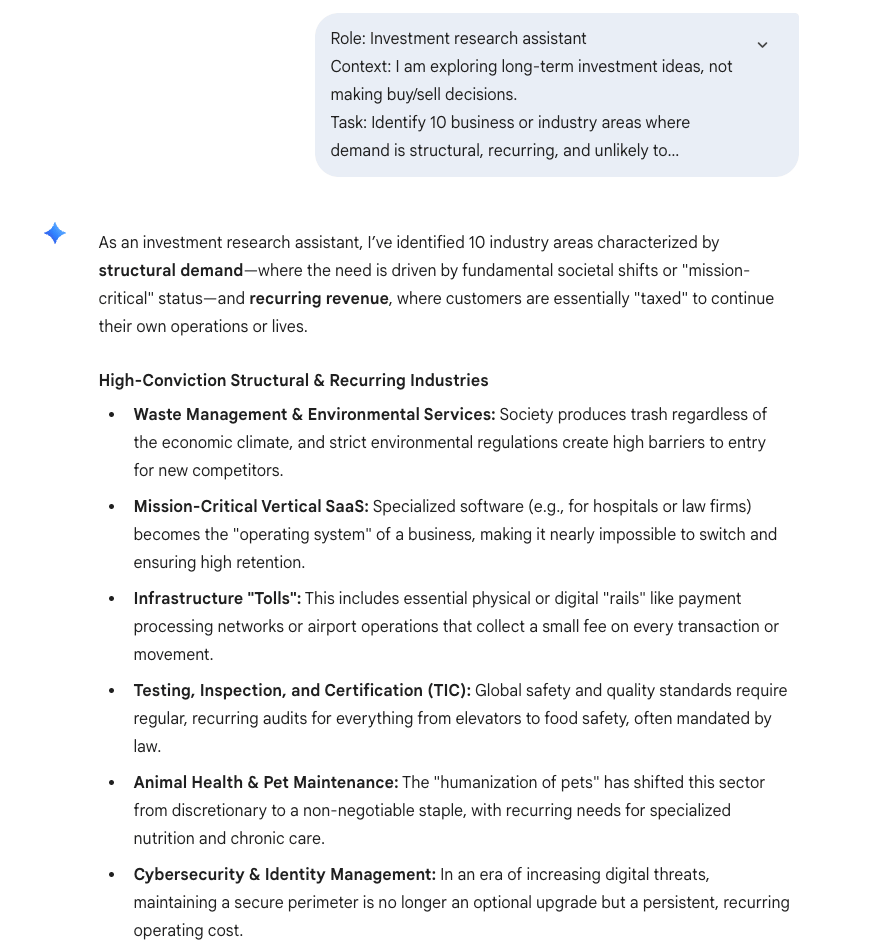

Role: Investment research assistant

Context: I am exploring long-term investment ideas, not making buy/sell decisions.

Task: Identify 10 business or industry areas where demand is structural, recurring, and unlikely to disappear.

Include both obvious and non-obvious areas.

Format: Bullet list with a one-sentence explanation for each.

Constraints: Avoid naming specific stocks.

What you’re looking for:

Boring businesses

Mandatory spend

Regulation, inertia, or switching costs

Most ideas die here. That’s good.

Mode 2: First-Pass Filtering (Kill Fast)

Now you pressure-test structure, not performance.

Prompt:

Role: Skeptical research analyst

Context: I am evaluating whether an industry is worth deeper research.

Task: Analyze the typical business model in this industry.

Cover:

- Revenue quality (recurring vs transactional)

- Customer switching costs

- Regulatory or operational risks

- Common reasons companies fail

Format: Clear bullet points.

Tone: Neutral and critical.

If you can’t explain why companies make money in plain English, stop.

Mode 3: Stress Testing (Think Like a Doubter)

Only now do you let AI argue against the idea.

Prompt:

Role: Bearish analyst

Context: I am intentionally stress-testing an investment idea before committing time or money.

Task: List the strongest arguments against this type of business.

Include:

- Industry-level risks

- Incentive misalignment

- What would need to change for this to underperform long-term

Format: Numbered list.

Here’s the part people miss:

Good research feels uncomfortable. If AI agrees with you too easily, you’re doing it wrong.

Infographic Image Prompt:

A simple three-step visual flow: “Discover → Filter → Stress Test.” Each step shown as a clean box with short labels. Editorial infographic style, neutral colors, professional, minimal text.

ROI Prompts

ROI Prompt 1:

Role: Research summarizer

Context: I have notes from articles, earnings calls, and reports.

Task: Synthesize the core business risks and opportunities from the pasted material.

Format: Two sections: “What Helps This Business” and “What Hurts This Business.”

Input: [PASTE NOTES HERE]

ROI Prompt 2:

Role: Comparative analyst

Context: I want to compare similar businesses without focusing on stock prices.

Task: Compare these business models on incentives, durability, and complexity.

Format: Table-style bullets under each company name.

Input: [COMPANY OR BUSINESS TYPE A] vs [COMPANY OR BUSINESS TYPE B]

ROI Prompt 3:

Role: Long-term thinker

Context: I am evaluating an idea with a 5–10 year horizon.

Task: Describe what must remain true for this business to succeed over the next decade.

Also list what would invalidate the thesis.

Format: Two bullet lists.

Full Example Prompt

Full Research Prompt:

Role: Senior investment research assistant

Context: I am researching a potential long-term investment idea for educational purposes.

Task:

1. Explain how this type of business actually makes money.

2. Identify structural advantages and weaknesses.

3. Highlight risks that are easy to underestimate.

4. List follow-up questions I should answer before going deeper.

Format:

- Sectioned response with clear headers

- Plain English explanations

Input: [DESCRIBE THE BUSINESS OR INDUSTRY]

Bonus Prompts

Bonus Prompt 1:

Explain this business model as if to a smart high school student.

Bonus Prompt 2:

What incentives do management teams in this industry typically respond to?

Bonus Prompt 3:

Where do analysts most commonly overestimate growth here?

Bonus Prompt 4:

What does this industry look like if technology improves but demand stays flat?

Bonus Prompt 5:

What adjacent industries benefit if this one grows?

Bonus Prompt 6:

What would surprise investors negatively about this business?

Bonus Prompt 7:

Which parts of this business are hardest to scale?

Bonus Prompt 8:

What customer complaints actually indicate pricing power?

Bonus Prompt 9:

What signals would suggest this industry is getting worse, not better?

Bonus Prompt 10:

If you could only track three metrics for this business long-term, what would they be and why?

Recap & Close

Investment research is about filtering, not forecasting

AI works best before opinions and prices enter the picture

Good research removes options instead of adding them

One takeaway:

If you don’t know why something fails, you don’t understand it.

One action:

Run one industry you’re curious about through the three-step workflow above. Stop when it stops earning your attention.

Wrap-Up Image Prompt:

A clean closing image of a notebook with the word “Clarity” on the cover, next to a simple pen and a closed laptop. Calm, thoughtful, professional editorial style.

Pro‑Grade Material Weights in SecondsBuilt for contractors, architects, and engineers.

Trusted by Pros Nationwide. |

About This Newsletter

AI Super Simplified is where busy professionals learn to use artificial intelligence without the noise, hype, or tech-speak. Each issue unpacks one powerful idea and turns it into something you can put to work right away.

From smarter marketing to faster workflows, we show real ways to save hours, boost results, and make AI a genuine edge — not another buzzword.

Get every new issue at AISuperSimplified.com — free, fast, and focused on what actually moves the needle.

How was today's edition?

If you enjoyed this issue and want more like it, subscribe to the newsletter.

Brought to you by Stoneyard.com • Subscribe • Forward • Archive